Industry

Fintech

Client

Bolt Financial, Inc.

Bolt Super App

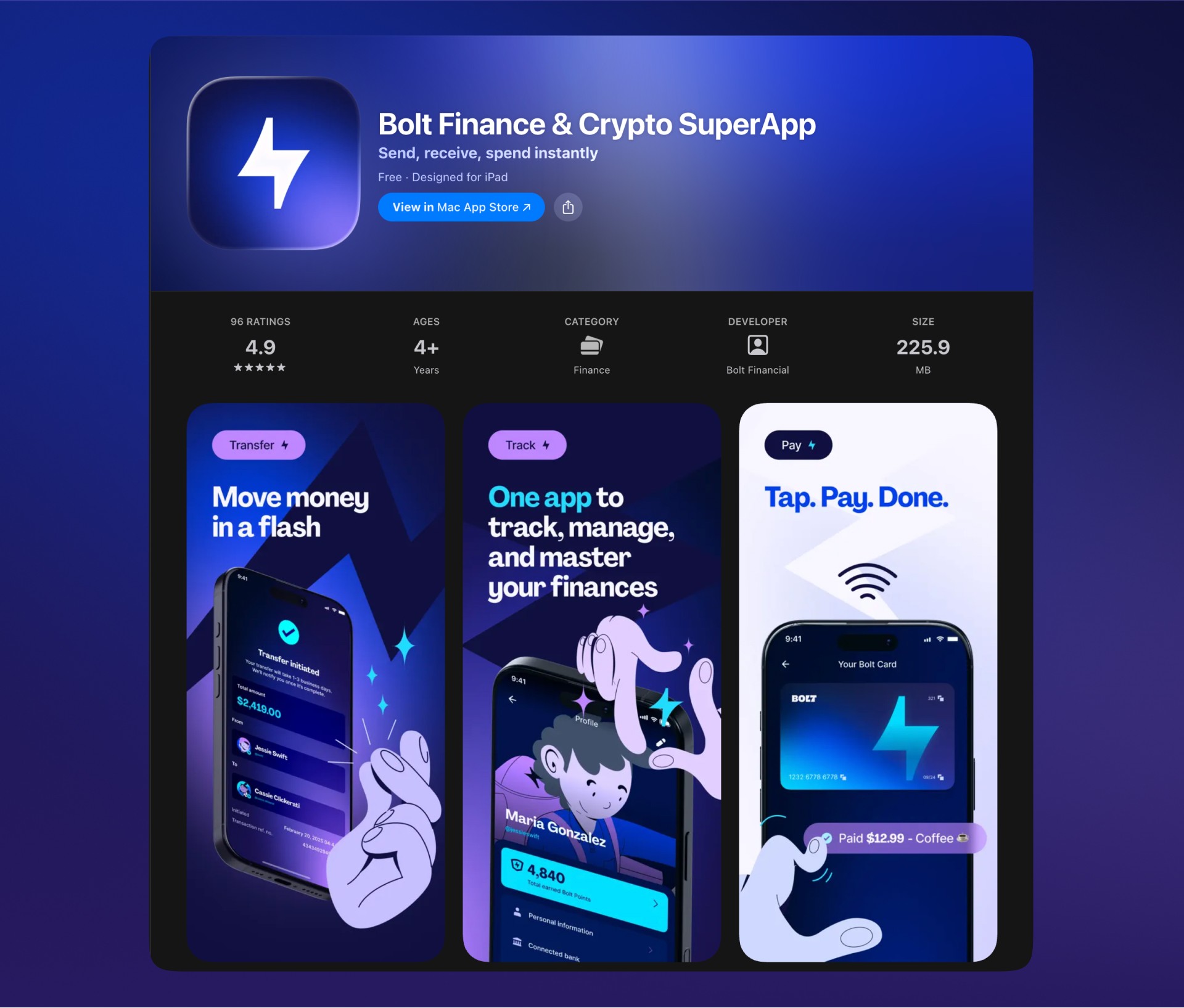

Building one of America’s early fintech super apps from zero to scale

Bolt Super App was a zero-to-one initiative to expand Bolt’s payments and commerce expertise into a consumer-facing financial platform. The goal was ambitious: unify banking, cards, crypto, payroll, payments, rewards, and commerce tracking into a single, trusted experience—something that had not yet successfully existed in the U.S. market.

I joined the project at a highly early stage as the founding and lead product designer. There was no design system, no established UX patterns, and no existing product foundation. My responsibility was not just to design screens, but to define the product experience, establish scalable systems, and lead design execution as the product evolved from concept to a production-ready platform.

Product Vision & Framing

Managing finances in the U.S. typically requires juggling multiple apps—one for payments, another for budgeting, another for crypto, another for rewards, and more. This fragmentation increases cognitive load, creates trust issues, and makes even simple tasks feel complex.

The core product vision for Bolt Super App was to reduce this fragmentation by creating a unified financial hub. Instead of optimizing isolated features, the focus was on designing a single, coherent experience where different financial tools naturally worked together. From the beginning, the challenge was less about feature depth and more about clarity, trust, and system cohesion across highly regulated domains.

As a design lead, I helped shape this vision into a clear experience strategy—defining what belonged in the core product, how users should mentally model the app, and how complexity could be progressively revealed without overwhelming users.

Research, Discovery & Direction

Early discovery work revealed that users were not asking for more features, but for consolidation and predictability. While people were already accustomed to using multiple financial tools, they were increasingly frustrated by constant context switching, duplicated information, and unclear mental models. Even simple financial tasks felt heavier than they needed to be, not because of complexity alone, but because everything lived in separate places.

Through competitive analysis of global financial platforms and early usability testing, several clear patterns emerged. Users naturally grouped balances, payments, rewards, and activity into a single mental space, expecting these elements to work together rather than exist in isolation. Clear navigation and information hierarchy consistently proved more valuable than novel interactions or visual flair, and trust and transparency mattered more than raw speed in financial workflows.

These insights directly informed the product’s information architecture, onboarding strategy, and dashboard design. Instead of pushing users into siloed sections, the experience was structured around a unified financial overview with clear, intentional paths into deeper workflows—reinforcing a sense of control, clarity, and trust from the first interaction.

Design Execution

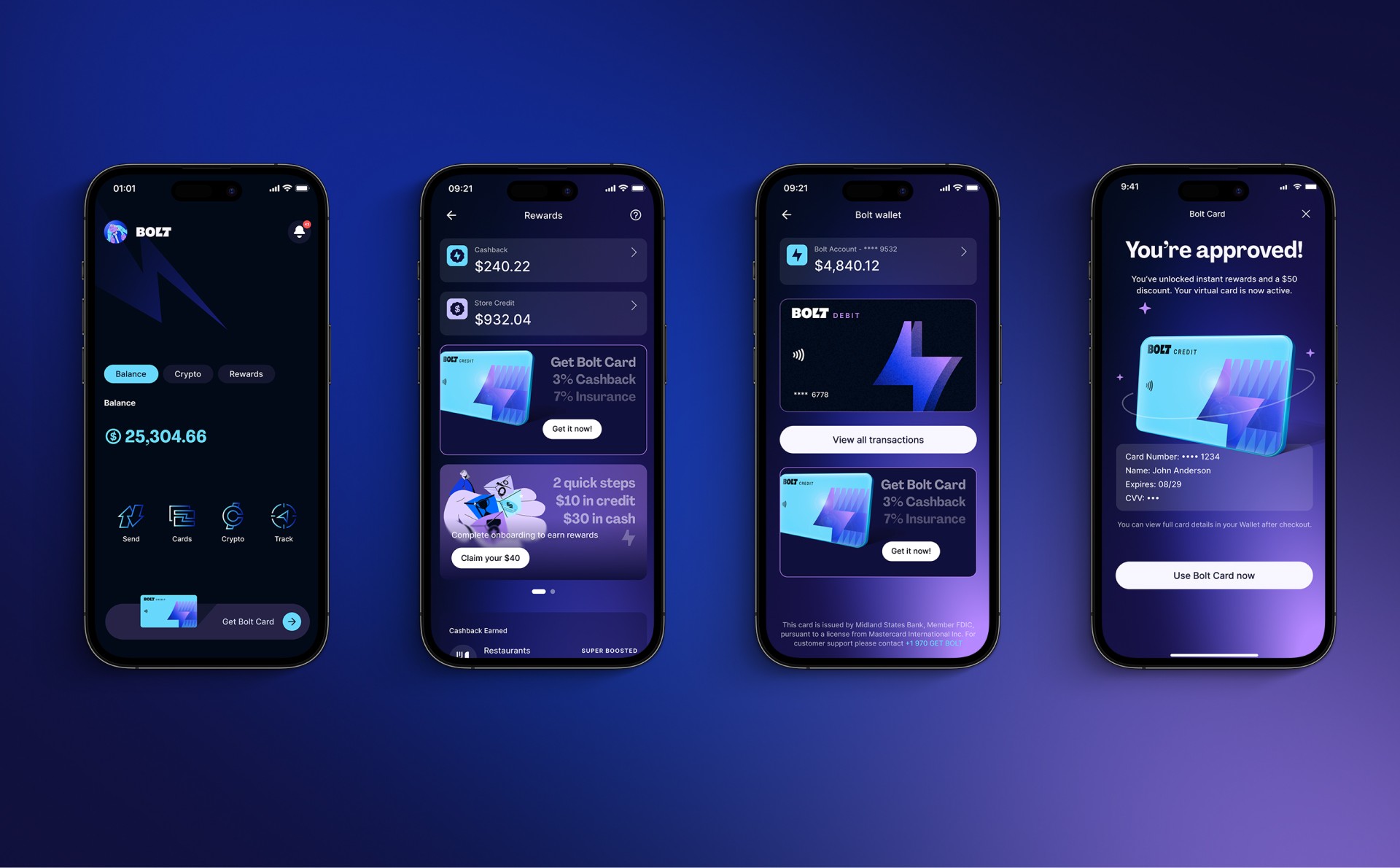

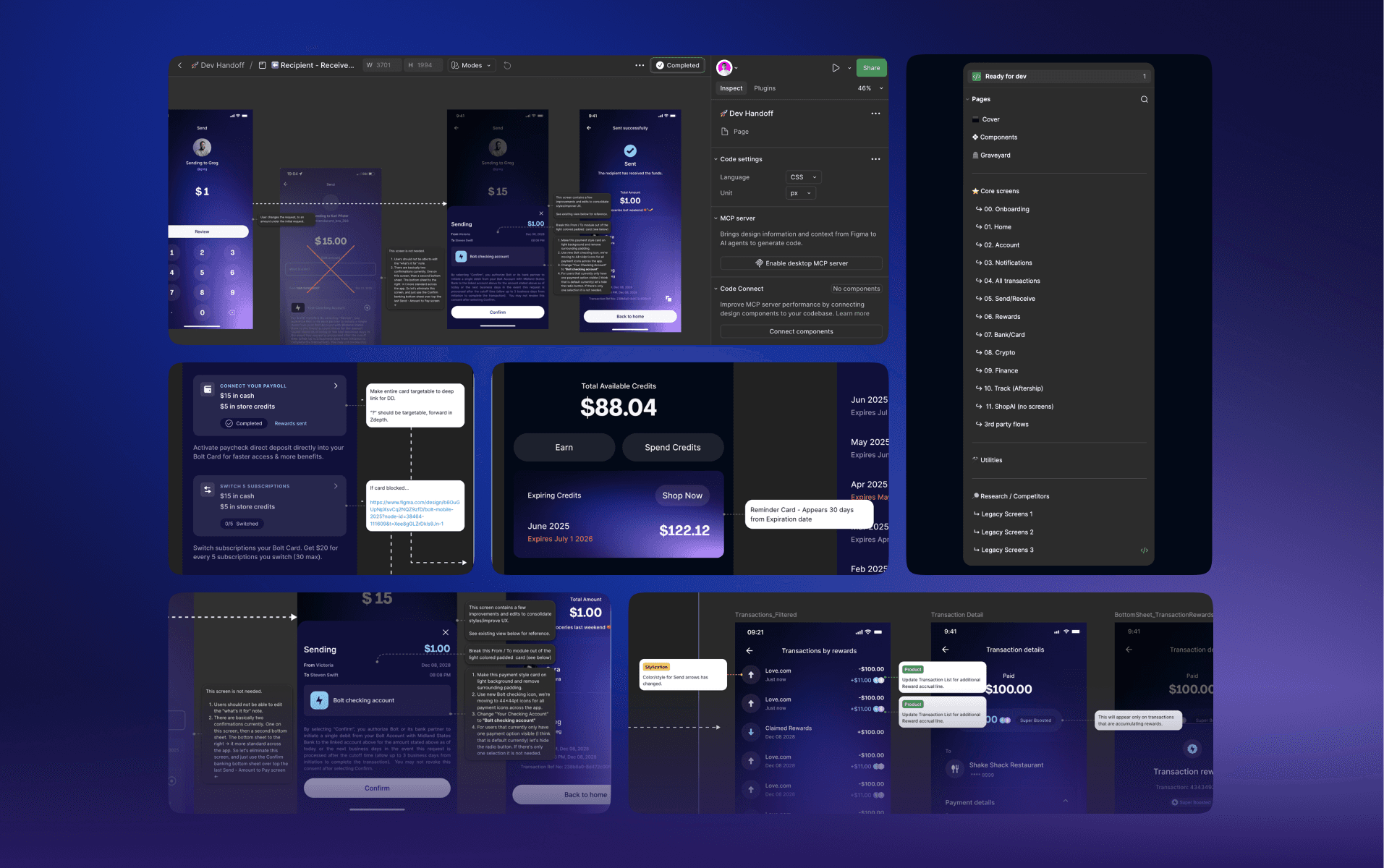

I led the end-to-end design of all primary product experiences, guiding each flow from early wireframes through high-fidelity, production-ready designs. The consistent focus throughout execution was reducing friction while maintaining clarity, trust, and compliance across highly regulated financial workflows.

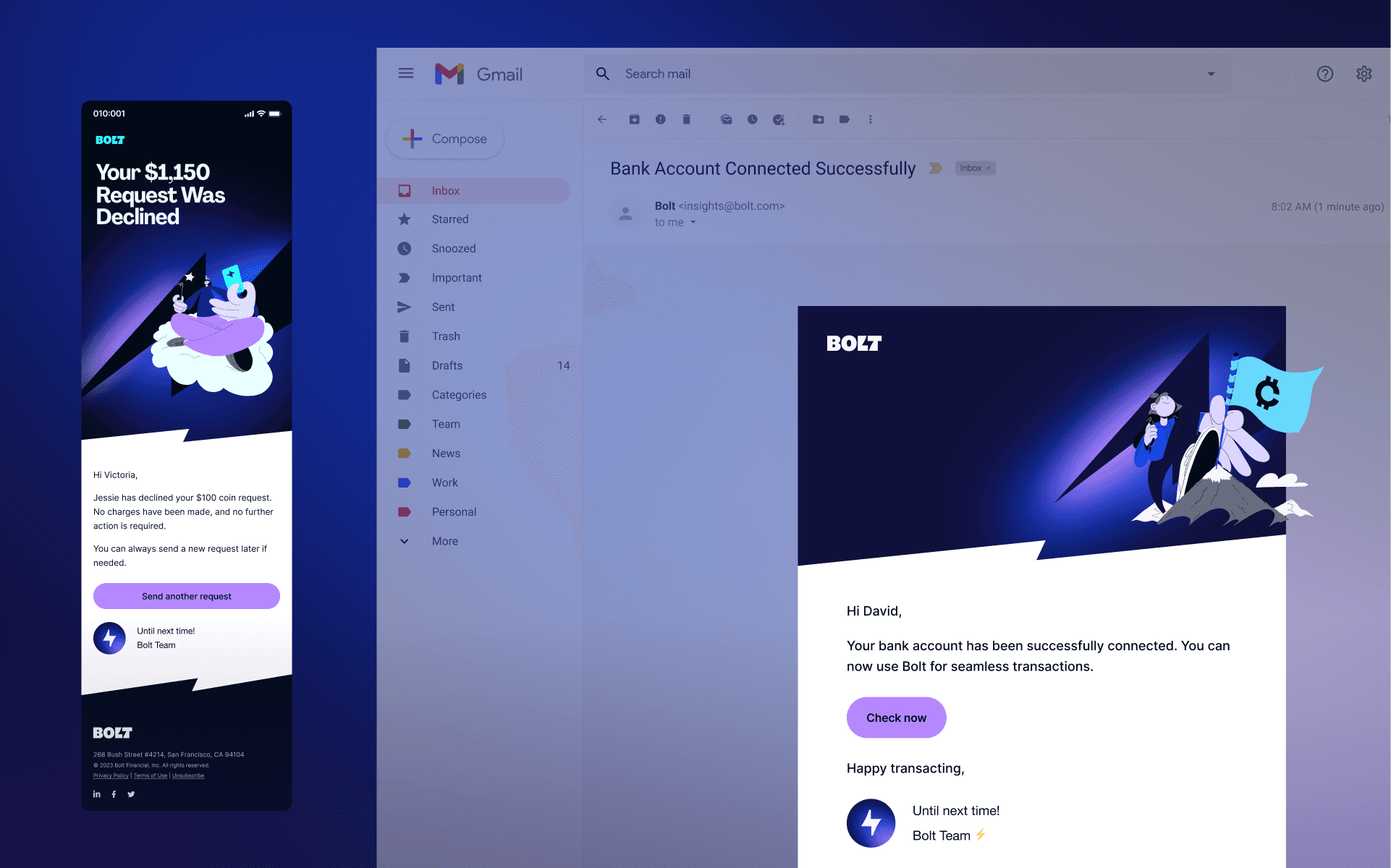

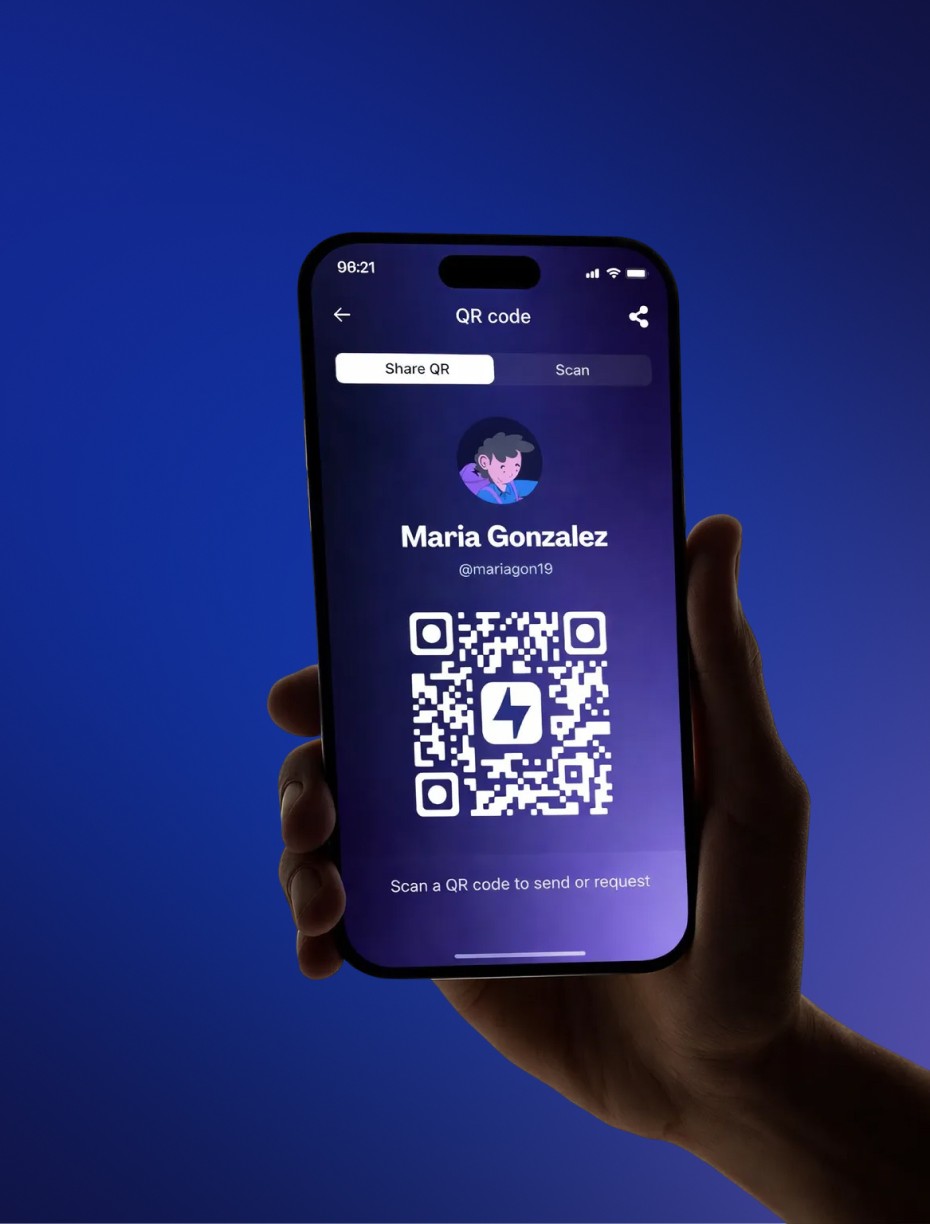

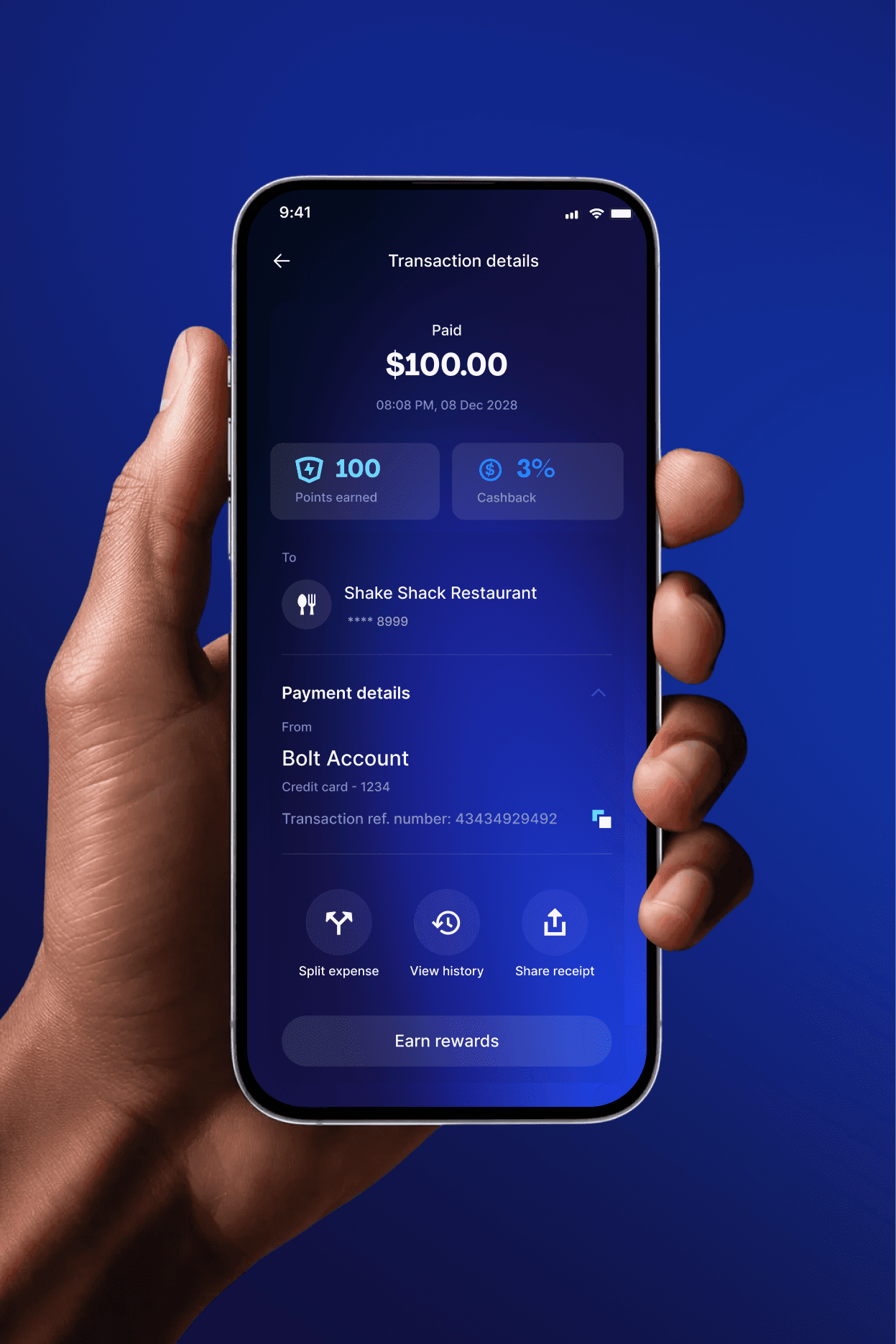

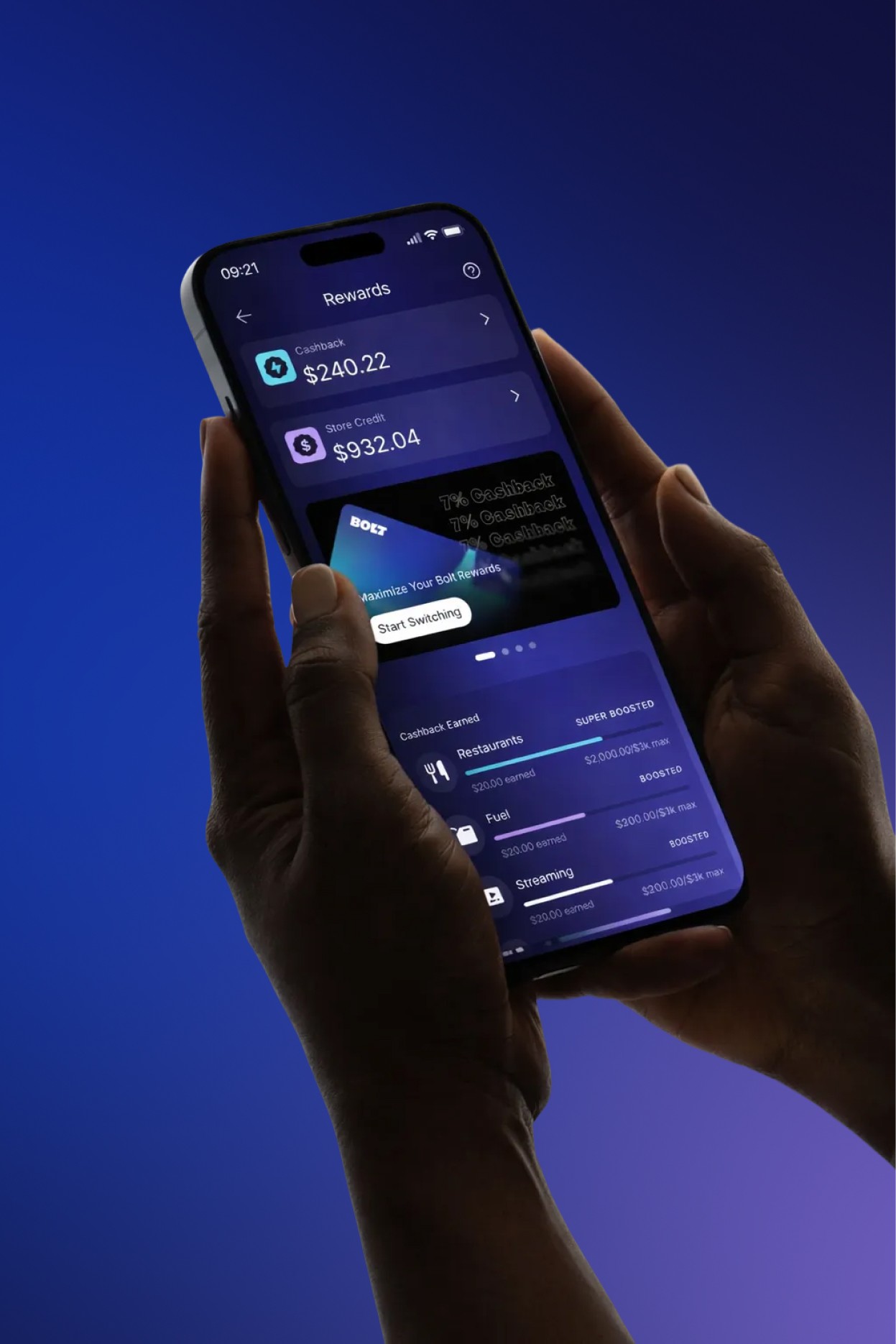

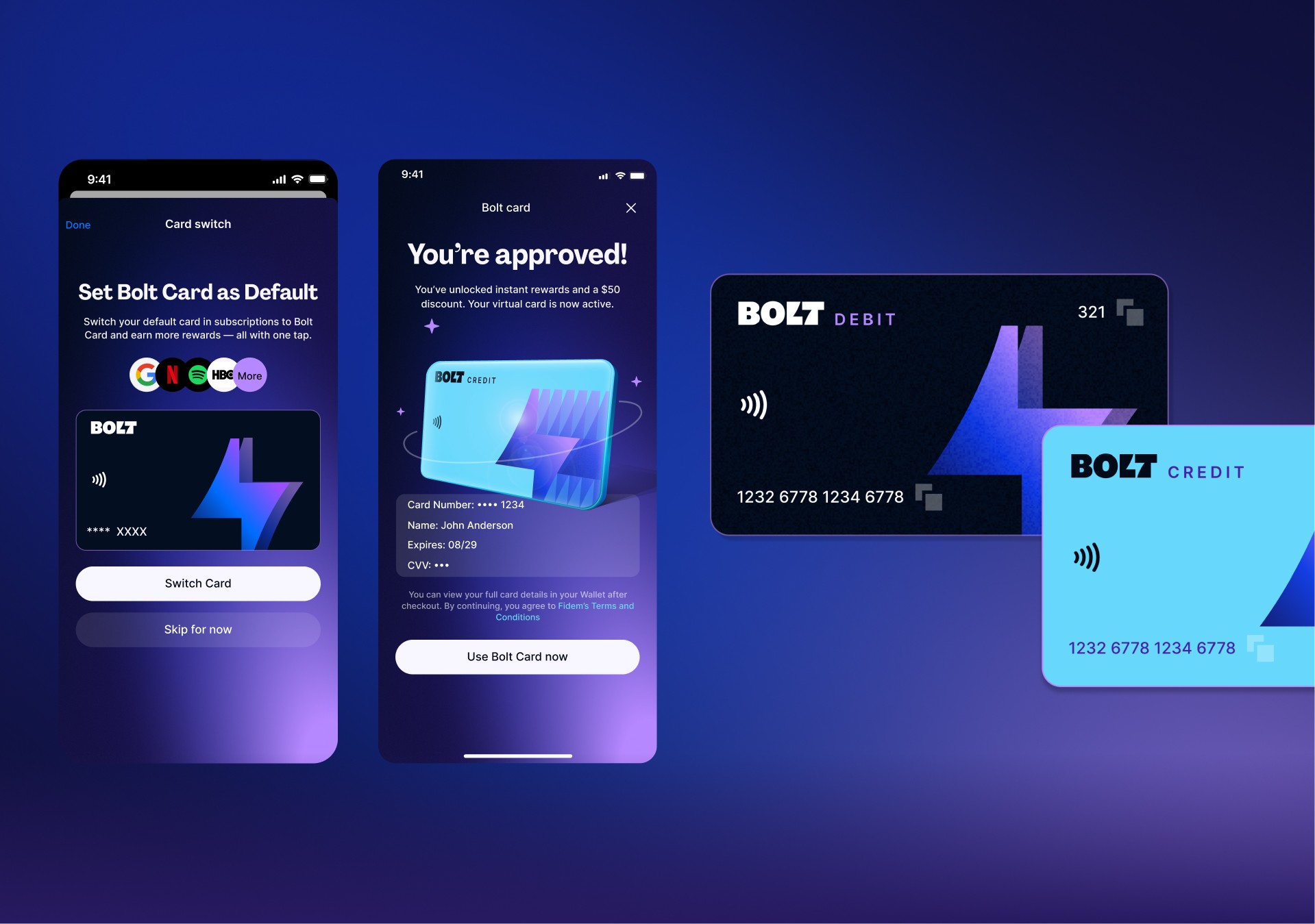

Core experiences included unified onboarding and authentication with clear disclosures, a central home dashboard that surfaced cash, crypto, rewards, cards, and activity at a glance, and peer-to-peer payments supporting both money and crypto. I also designed crypto buy, sell, send, deposit, and portfolio management flows specifically for non-expert users, along with card controls, transaction visibility, subscription management, payroll deposits, banking flows, and predictable money movement.

Integrated commerce tracking extended the product beyond finance, reinforcing the idea of a single, everyday financial hub. Rather than treating these as isolated features, every experience was designed as part of one continuous financial journey, supported by consistent interaction patterns and feedback across the app.

Design Execution & Core Experiences

Given the scope and long-term ambition of a super app, it was clear early on that a feature-first approach would not scale. I prioritized building a strong design foundation before product complexity increased. I designed Bolt’s initial design system from scratch, establishing clear layout structures, spacing rules, and hierarchy, along with reusable components for transactions, confirmations, errors, and disclosures.

The system introduced consistent patterns that worked seamlessly across banking, crypto, cards, and rewards, with accessibility and compliance considerations embedded from day one. This system became the backbone of the product—enabling faster iteration, reducing UX fragmentation, and allowing new designers to onboard later without disrupting the core experience or requiring redesigns.

Cross-Team & Partner Collaboration

A significant part of my role involved acting as a design bridge between internal teams and external partners. I worked closely with product, engineering, compliance, and multiple third-party providers across crypto, banking, payroll, and commerce to ensure alignment from concept through delivery.

My responsibility was to translate technical, legal, and regulatory requirements into experiences that felt simple, human, and trustworthy—without hiding critical information. This required continuous collaboration, clear communication, and thoughtful trade-offs between usability, compliance, and speed. As the team scaled, I also supported onboarding of additional designers, reviewed work to maintain system consistency, and ensured the original product vision remained intact as delivery velocity increased.

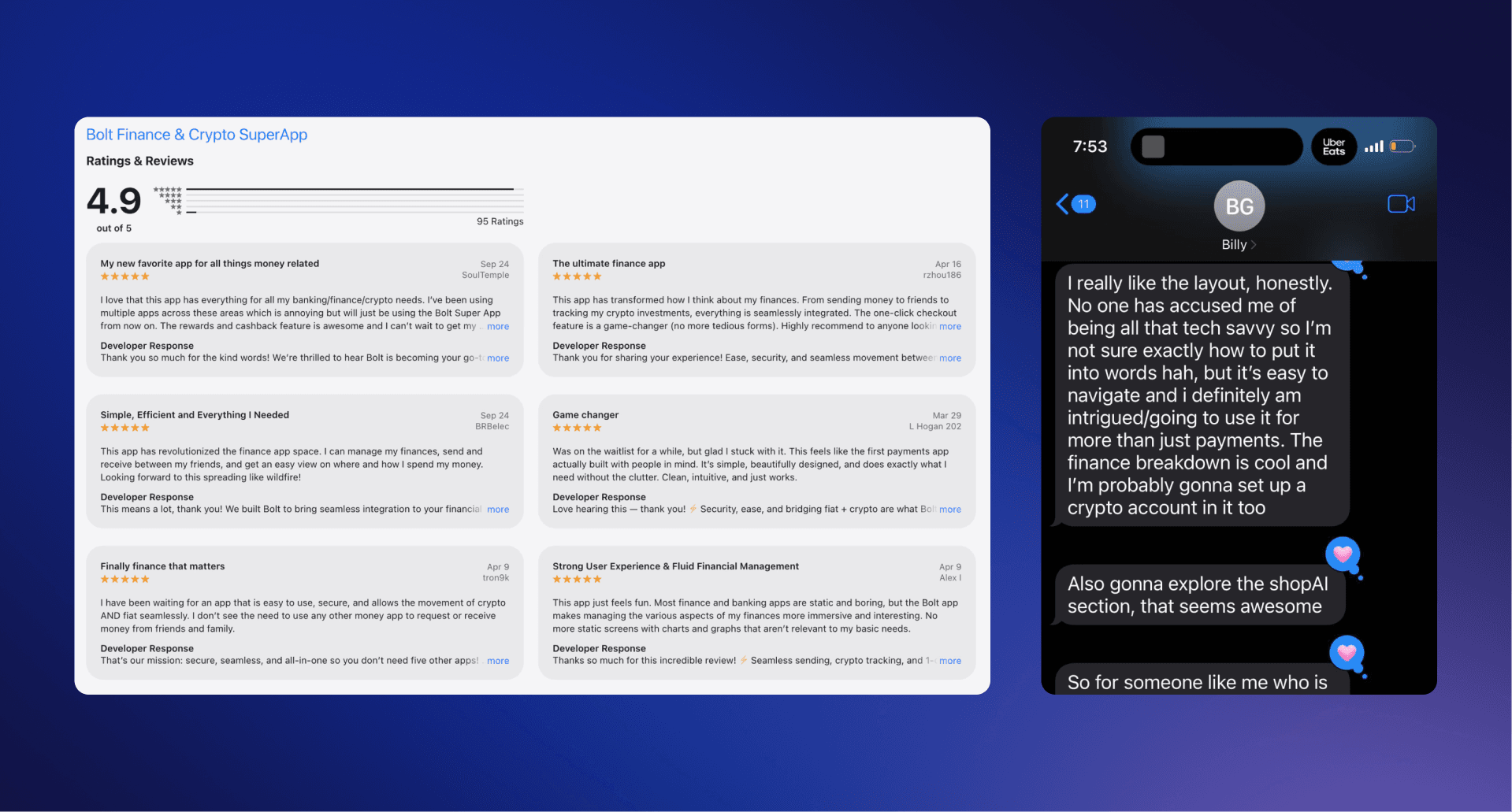

Impact & Outcomes

Bolt Super App established a scalable foundation for a multi-domain fintech product in the U.S. market. The work resulted in a successful zero-to-one super app experience, supported by a robust design system capable of scaling across multiple regulated domains. The system enabled rapid feature expansion without sacrificing UX clarity, while multiple third-party integrations were brought together into a single, cohesive product experience. The design standards and foundations established during this phase continued to support the product as the team and scope grew.

When designed correctly, a super app stops feeling like many tools and starts feeling like one place.

Unknown